The National Pension System (NPS) is a government-sponsored retirement savings scheme designed to provide financial security to individuals post-retirement. As you approach the age of 40, it becomes increasingly important to consider how to build a substantial retirement corpus that can support your lifestyle. This blog will explore how to achieve a monthly pension of ₹55,000 along with a corpus of ₹2.5 crore by investing in NPS, with a focus on the investment strategy and benefits of this pension scheme.

Understanding NPS

The NPS is aimed at providing retirement income to citizens of India. It allows individuals to contribute regularly during their working life and accumulate a corpus that can be used for retirement. The scheme offers several advantages, including:

- Tax Benefits: Contributions to NPS are eligible for tax deductions under sections 80CCD(1) and 80CCD(1B) of the Income Tax Act, which can significantly reduce your taxable income.

- Market-Linked Returns: The returns on NPS investments are market-linked, which means they can potentially offer higher returns compared to traditional products in the market.

- Flexibility: Subscribers can choose their investment mix among equity, corporate bonds, government securities, and alternative investment funds.

Calculating Your Pension Needs

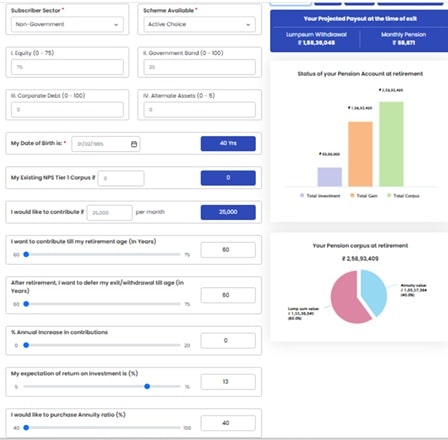

To achieve a monthly pension of ₹55,000 and a retirement corpus of ₹2.5 crore, we need to break down the numbers:

- Monthly Investment Requirement: To accumulate a corpus of ₹2.5 crore by retirement (let’s assume at age 60), you would need to invest approximately ₹25,000 per month.

- Expected Rate of Return (ROI): Assuming an average ROI of 13% per annum, which is attainable through aggressive equity investments within the NPS framework.

Using an NPS calculator or manual calculation, we can determine the future value of these investments.

Achieving Your Pension Goals

Once you have established your target corpus and monthly contributions, it’s essential to implement a disciplined investment strategy:

- Regular Contributions: Make it a habit to contribute consistently every month.

- Monitor Your Investments: Regularly review your portfolio and adjust your asset allocation based on market conditions and personal risk appetite.

- Tax Planning: Utilize the tax benefits effectively to maximize your contributions.

Why Choose NPS?

The NPS stands out as an excellent product for retirement pension plan due to its unique features:

- Long-Term Growth Potential: With market-linked returns, NPS has the potential for significant growth over time.

- Safety Net for Retirement: It ensures that individuals have a steady income post-retirement.

- Low Management Fees: Compared to mutual funds and other investment options, NPS typically has lower management fees.

Conclusion

As you approach your 40s, it’s crucial to take proactive steps towards securing your financial future. By investing ₹25,000 monthly in the National Pension System with an expected ROI of 13%, you can achieve both a substantial corpus and a comfortable monthly pension upon retirement. The combination of tax benefits, flexibility in investment choices, and market-linked growth makes NPS an attractive option for retirement planning. Start today to ensure that you enjoy a financially secure tomorrow!